If you’ve been stressed about crypto taxes, the IRS Crypto FIFO Relief might be a game-changer for your strategy. Let’s break down what this means, why it matters, and how you can use it to save money (and headaches) this tax season.

What is IRS Crypto FIFO Relief?

FIFO stands for First-In, First-Out—a fancy way of saying the first crypto you buy is treated as the first you sell. For years, the IRS required crypto investors to use FIFO when calculating taxes. But here’s the catch: if your oldest crypto was bought cheap, selling it during a price surge could mean massive tax bills.

The IRS Crypto FIFO Relief isn’t a new law but a clarification. The IRS allows you to avoid FIFO if you can prove exactly which coins you sold and when. This flexibility is the “relief” everyone’s talking about. Think of it like picking which apples to sell from your orchard—instead of grabbing the oldest ones first, you can choose the ones that save you the most money.

Also Read – How to Buy Base Crypto Safely and Securely: Tips for New Investors

Why FIFO Was a Nightmare for Crypto Investors

Imagine this: You bought 1 Bitcoin for $10,000 in 2020 and another for $50,000 in 2023. Now, in 2024, you decide to sell 1 Bitcoin for $60,000.

Under FIFO (First In, First Out), the IRS assumes you sold the $10,000 Bitcoin first, meaning your taxable gain is $50,000—ouch! That’s a hefty tax bill.

🚀 The Good News? With IRS Crypto FIFO Relief, you can now use Specific Identification (Spec ID) instead. If you can prove that you sold the $50,000 Bitcoin instead of the $10,000 one, your taxable gain drops to just $10,000—a massive $40,000 reduction in taxable income!

How IRS Crypto FIFO Relief Offers Flexibility

The key to unlocking this relief is documentation. The IRS wants proof that you’re tracking each crypto purchase and sale. Here’s what you need:

- Dates of every buy/sell.

- Cost (price paid) for each transaction.

- Wallet addresses or exchange records.

Tools like crypto tax software (e.g., CoinTracker, Koinly) can automate this. The better your records, the easier it is to use Spec ID and minimize taxes.

Also Read – Capybaranation Crypto Price Prediction: What You Need to Know in 2025

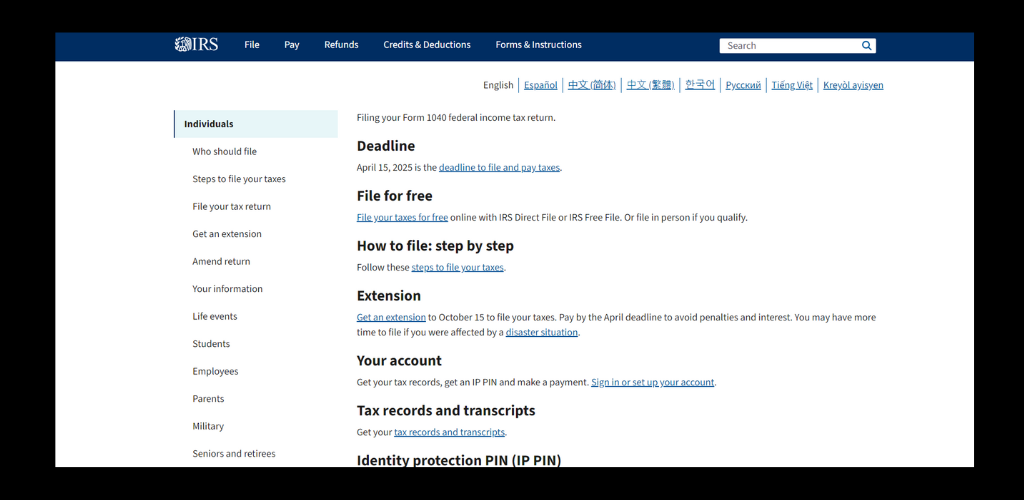

3 Steps to Use IRS Crypto FIFO Relief in 2024

- Track Everything: Use spreadsheets or apps to log every trade.

- Choose Your Method: Decide before filing if you’ll use FIFO, LIFO (Last-In, First-Out), or Spec ID.

- Stay Consistent: Once you pick a method, stick with it unless the IRS approves a change.

Pro Tip: If you’re sitting on crypto bought at different prices, sell the highest-cost coins first to lower gains.

Common Mistakes to Avoid

- Guessing: Don’t assume the IRS will accept vague records. “I think I sold the newer coins” won’t cut it.

- Mixing Wallets: Moving crypto between wallets? Track those transfers—it matters for cost basis.

- Ignoring Software: Manual tracking is error-prone. Use tools to avoid audits.

Final Thoughts: Turning Relief into Savings

The IRS Crypto FIFO Relief isn’t about changing rules—it’s about using them smarter. By keeping detailed records and choosing the right accounting method, you can legally shrink your tax bill.

Still confused? Talk to a crypto-savvy tax pro. And remember: the IRS is watching crypto closely. Stay organized, stay compliant, and let FIFO relief work for you.